Essay

Emelie and Taylor are employed by the Federal government and own their home in Washington,

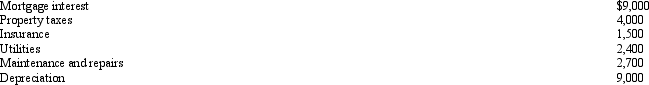

D.C.While vacationing in the summer for three weeks, they rent their home for two weeks to an Angolian diplomat for $3,000.During the third week, they permit Taylor's aunt and uncle to stay in the house with no rent being charged.Expenses associated with the home for the year are as follows:

Determine the effect of these income and expense items associated with their home if they file a joint return.

Determine the effect of these income and expense items associated with their home if they file a joint return.

Correct Answer:

Verified

Since Emelie and Taylor rent their home ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The ordinary and necessary expenses for operating

Q6: Rose's business sells air conditioners which have

Q8: Depending on the nature of the expenditure,

Q10: During the year, Jim rented his vacation

Q10: Which of the following statements is correct

Q11: The income of a sole proprietorship are

Q12: On January 2, 2012, Fran acquires a

Q13: Priscella pursued a hobby of making bedspreads

Q14: The only § 212 expenses that are

Q87: What losses are deductible by an individual