Essay

During the year, Martin rented his vacation home for three months and spent one month there.Gross rental income from the property was $5,000.Martin incurred the following expenses: mortgage interest, $3,000; real estate taxes, $1,500; utilities, $800; maintenance, $500; and depreciation, $4,000.Compute Martin's allowable deductions for the vacation home.

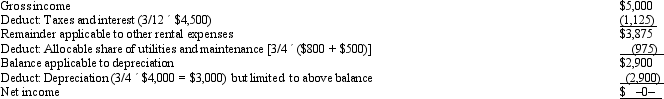

Since the vacation home is rented for 15 or more days and is used for personal purposes for more than the greater of (1) 14 days or (2) 10% of the rental days, the deductions are scaled down, using the court's approach, as follows:

Thus, Martin may deduct $1,125 taxes and interest, $975 utilities and maintenance, and $2,900 depreciation against the gross income of $5,000.The personal portion of taxes and interest ($3,375) is deductible as an itemized deduction.Example 29

Thus, Martin may deduct $1,125 taxes and interest, $975 utilities and maintenance, and $2,900 depreciation against the gross income of $5,000.The personal portion of taxes and interest ($3,375) is deductible as an itemized deduction.Example 29

Correct Answer:

Verified

Using the IRS's approach, though, the de...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: If a vacation home is rented for

Q11: Assuming an activity is deemed to be

Q58: Susan is a sales representative for a

Q61: Which of the following must be capitalized

Q81: Briefly discuss the two tests that an

Q95: In determining whether an activity should be

Q101: A taxpayer who claims the standard deduction

Q103: Which of the following is relevant in

Q107: Which of the following is correct?<br>A)A personal

Q108: Under no circumstance can a loss on