Essay

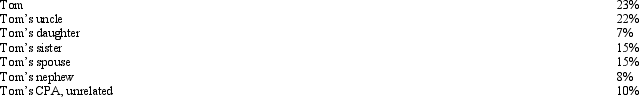

The stock of Eagle, Inc.is owned as follows:

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Correct Answer:

Verified

Tom's realized loss is $13,000.

Howeve...

Howeve...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: If a vacation home is classified as

Q16: Olive, Inc., an accrual method taxpayer, is

Q22: Describe the circumstances under which a taxpayer

Q34: The period in which an accrual basis

Q60: Trade or business expenses are classified as

Q73: A hobby activity can result in all

Q88: LD Partnership, a cash basis taxpayer, purchases

Q151: Beulah's personal residence has an adjusted basis

Q152: Which of the following is deductible as

Q153: The expenses incurred to investigate the expansion