Essay

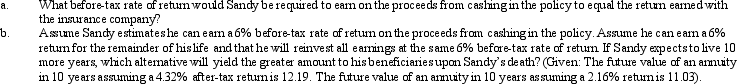

Sandy is married, files a joint return, and expects to be in the 28% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $100,000.He paid $60,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy, the insurance company will pay him $3,000 (3%) interest each year.Sandy thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Beverly died during the current year. At

Q29: Juan was considering purchasing an interest in

Q37: For a person who is in the

Q45: Carin, a widow, elected to receive the

Q47: Julie was suffering from a viral infection

Q53: Swan Finance Company, an accrual method taxpayer,

Q54: Theresa sued her former employer for age,

Q55: Kristen's employer owns its building and provides

Q64: What Federal income tax benefits are provided

Q113: Mel was the beneficiary of a $45,000