Essay

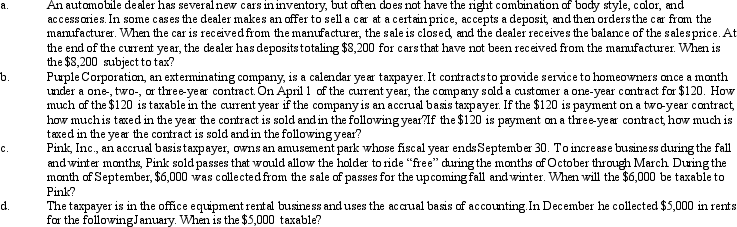

Determine the proper tax year for gross income inclusion in each of the following cases.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: In the case of a person with

Q39: When a business is operated as an

Q84: A cash basis taxpayer purchased a certificate

Q85: A sole proprietorship purchased an asset for

Q86: Green, Inc., provides group term life insurance

Q87: The annual increase in the cash surrender

Q88: The B & W partnership earned taxable

Q90: In December 2012, Mary collected the December

Q91: At the beginning of 2013, Mary purchased

Q94: Lois, who is single, received $9,000 of