Multiple Choice

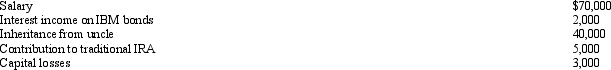

During 2012, Esther had the following transactions:  Esther's AGI is:

Esther's AGI is:

A) $62,000.

B) $64,000.

C) $67,000.

D) $102,000.

E) $104,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q30: Dan and Donna are husband and wife

Q33: Debby, age 18, is claimed as a

Q33: A qualifying child cannot include:<br>A)A nonresident alien.<br>B)A

Q36: In 2012, Hal furnishes more than half

Q37: Under the Federal income tax formula for

Q39: A child who is married can be

Q50: Many taxpayers who previously itemized will start

Q55: Deductions for AGI are often referred to

Q79: Married taxpayers who file a joint return

Q81: As opposed to itemizing deductions from AGI,