Multiple Choice

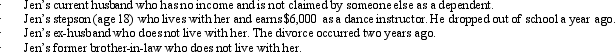

During 2012, Jen (age 66) furnished more than 50% of the support of the following persons:  Presuming all other dependency tests are met, on a separate return how many personal and dependency exemptions may Jen claim?

Presuming all other dependency tests are met, on a separate return how many personal and dependency exemptions may Jen claim?

A) Two.

B) Three.

C) Four.

D) Five.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: Lee, a citizen of Korea, is a

Q50: Ashley earns a salary of $55,000, has

Q51: Gain on the sale of collectibles held

Q52: Jayden and Chloe Harper are husband and

Q53: Butch and Minerva are divorced in December

Q56: Regarding the rules applicable to filing of

Q57: Tony, age 15, is claimed as a

Q58: Millie, age 80, is supported during the

Q59: The basic and additional standard deductions are

Q101: In resolving qualified child status for dependency