Essay

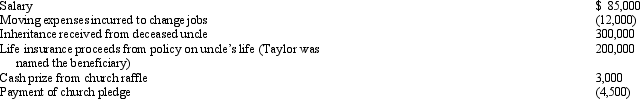

Taylor had the following transactions for 2012:

What is Taylor's AGI for 2012?

What is Taylor's AGI for 2012?

Correct Answer:

Verified

$76,000.$85,000 (salary) + $3,000 (raffl...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$76,000.$85,000 (salary) + $3,000 (raffl...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q5: Tom is single and for 2012 has

Q6: In which, if any, of the following

Q7: Kyle, whose wife died in December 2009,

Q9: When the kiddie tax applies and the

Q11: Howard, age 82, dies on January 2,

Q13: In which, if any, of the following

Q14: For the qualifying relative category (for dependency

Q15: Jason and Peg are married and file

Q51: When can a taxpayer not use Form

Q105: The major advantage of being classified as