Essay

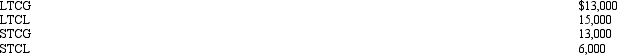

During 2012, Madison had salary income of $80,000 and the following capital transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

Combining the long-term transactions yie...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Combining the long-term transactions yie...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q109: For tax purposes, married persons filing separate

Q109: During 2012, Addison has the following gains

Q111: Using borrowed funds from a mortgage on

Q112: Under the income tax formula, a taxpayer

Q115: In 2012, Ed is 66 and single.If

Q117: The Hutters filed a joint return for

Q118: Nelda is married to Chad, who abandoned

Q119: Darren, age 20 and not disabled, earns

Q157: In order to claim a dependency exemption

Q176: Kim, a resident of Oregon, supports his