Multiple Choice

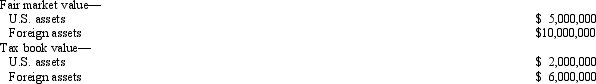

Qwan, a U.S.corporation, reports $250,000 interest expense for the tax year.None of the interest relates to nonrecourse debt or loans from affiliated corporations.Qwan's U.S.and foreign assets are reported as follows.  How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

A) Using tax book values.

B) Using tax book value for U.S.source and fair market value for foreign source.

C) Using fair market values.

D) Using fair market value for U.S.source and tax book value for foreign source.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: A nonresident alien with U.S.-source income effectively

Q16: USCo, a domestic corporation, reports worldwide taxable

Q17: Lang, an NRA who was not a

Q20: Dividends received from Leprechaun, Ltd., an Irish

Q21: A domestic corporation is one whose assets

Q22: Which of the following persons typically is

Q23: Which of the following statements regarding a

Q34: Krebs,Inc.,a U.S.corporation,operates an unincorporated branch manufacturing operation

Q58: Waldo,Inc.,a U.S.corporation,owns 100% of Orion,Ltd.,a foreign corporation.Orion

Q78: Section 482 is used by the Treasury