Multiple Choice

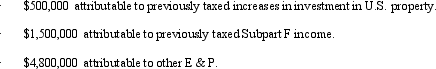

Xenia, Inc., a U.S.shareholder, owns 100% of Fredonia, a CFC.Xenia receives a $3 million cash distribution from Fredonia.Fredonia's E & P is composed of the following amounts.  Xenia recognizes a taxable dividend of:

Xenia recognizes a taxable dividend of:

A) $3 million.

B) $2.5 million.

C) $1.5 million.

D) $1 million.

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Chang, an NRA, is employed by Fisher,

Q40: Dividends received from a domestic corporation are

Q41: Which of the following determinations does not

Q42: Income tax treaties may provide for either

Q45: In 2013, George renounces his U.S.citizenship and

Q47: Abbott, Inc., a domestic corporation, reports worldwide

Q48: Which of the following is not a

Q54: The IRS can use § 482 reallocations

Q72: ForCo, a subsidiary of a U.S. corporation

Q98: The U.S.system for taxing income earned outside