Multiple Choice

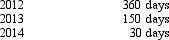

Shannon, a foreign person with a green card, spends the following days in the United States.  Shannon's residency status for 2014 is:

Shannon's residency status for 2014 is:

A) U.S.resident because she has a green card.

B) U.S.resident since she was a U.S.resident for the past immediately preceding two years.

C) Not a U.S.resident because Shannon was not in the United states for at least 31 days during 2014.

D) Not a U.S.resident since, using the three-year test, Shannon is not present in the United states for at least 183 days.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Your client holds foreign tax credit (FTC)

Q43: With respect to income generated by non-U.S.

Q50: Liang, an NRA, is sent to the

Q51: SunCo, a domestic corporation, owns a number

Q53: Arendt, Inc., a domestic corporation, purchases a

Q55: The residence of seller rule is used

Q57: Ridge, Inc., a domestic corporation, reports worldwide

Q58: ForCo, a foreign corporation, purchases widgets from

Q91: The purpose of the transfer pricing rules

Q98: The U.S.system for taxing income earned outside