Multiple Choice

Yvonne is a citizen of France and does not have permanent resident status in the United States.During the last three years she has spent a number of days in the United States.  Is Yvonne treated as a U.S.resident for the current year?

Is Yvonne treated as a U.S.resident for the current year?

A) No, because Yvonne is a citizen of France.

B) No, because Yvonne was not present in the United States at least 183 days during the current year.

C) No, because although Yvonne was present in the United States at least 31 days during the current year, she was not present at least 183 days in a single year during the current or prior two years.

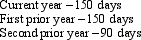

D) Yes, because Yvonne was present in the United States at least 31 days during the current year and 215 days during the current and prior two years (using the appropriate fractions for the prior years) .

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The U.S. system for taxing income earned

Q39: Discuss the primary purposes of income tax

Q48: Olaf, a citizen of Norway with no

Q73: The transfer of the assets of a

Q138: OutCo, a controlled foreign corporation in Meena,

Q140: RedCo, a domestic corporation, incorporates its foreign

Q143: GreenCo, a domestic corporation, earns $25 million

Q146: Amber, Inc., a domestic corporation receives a

Q147: During 2012, Martina, an NRA, receives interest

Q148: Which of the following statements regarding income