Multiple Choice

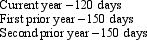

Magdala is a citizen of Italy and does not have permanent resident status in the United States.During the last three years she has spent a number of days in the United States.  Is Magdala treated as a U.S.resident for the current year?

Is Magdala treated as a U.S.resident for the current year?

A) Yes, because Magdala was present in the United States at least 31 days during the current year and 195 days during the current and prior two years (using the appropriate fractions for the prior years) .

B) No, because Magdala is a citizen of Italy.

C) No, because Magdala was not present in the United States at least 183 days during the current year.

D) No, because although Magdala was present in the United States at least 31 days during the current year, she was not present at least 183 days in a single year during the current or prior two years.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A Qualified Business Unit of a U.S.

Q21: ForCo, a foreign corporation, receives interest income

Q90: RainCo, a domestic corporation, owns a number

Q91: A U.S.corporation may be able to alleviate

Q92: Amber, Inc., a domestic corporation receives a

Q93: A controlled foreign corporation (CFC) realizes Subpart

Q95: WaterCo, a domestic corporation, purchases inventory for

Q96: Twenty unrelated U.S. persons equally own all

Q98: Which of the following would not prevent

Q123: Which of the following income items does