Essay

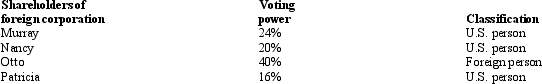

Given the following information, determine if FanCo, a foreign corporation, is a CFC.

Patricia is Murray's daughter.

Patricia is Murray's daughter.

Correct Answer:

Verified

Murray, Nancy, and Patricia are U.S.sha...

Murray, Nancy, and Patricia are U.S.sha...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: AirCo,a domestic corporation,purchases inventory for resale from

Q120: The source of income received for the

Q120: A U.S. business conducts international communications activities

Q122: Losses and deductions, similar to income items,

Q123: KeenCo, a domestic corporation, is the sole

Q125: Britta, Inc., a U.S.corporation, reports foreign-source income

Q126: Which of the following statements regarding a

Q127: Which of the following statements regarding the

Q128: Kipp, a U.S.shareholder under the CFC provisions,

Q144: Performance,Inc.,a U.S.corporation,owns 100% of Krumb,Ltd.,a foreign corporation.Krumb