Essay

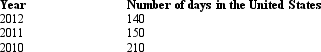

Given the following information, determine whether Greta, an alien, is a U.S.resident for 2012.Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Correct Answer:

Verified

If Greta would prefer a different resul...

If Greta would prefer a different resul...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: In allocating interest expense between U.S.and foreign

Q29: Which of the following statements regarding the

Q30: Gains on the sale of U.S.real property

Q32: Dark,Inc.,a U.S.corporation,operates Dunkel,an unincorporated branch manufacturing operation

Q34: Which of the following statements regarding the

Q35: OutCo, a controlled foreign corporation owned 100%

Q36: Which of the following statements is false

Q37: USCo, a domestic corporation, reports worldwide taxable

Q88: The § 367 cross-border transfer rules seem

Q108: In which of the following independent situations