Essay

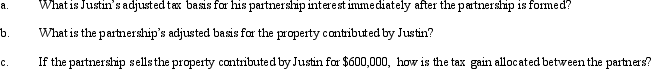

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Correct Answer:

Verified

Correct Answer:

Verified

Q115: At the beginning of the tax year,Zach's

Q143: When property is contributed to a partnership

Q144: Matt, a partner in the MB Partnership,

Q146: During the current year, MAC Partnership reported

Q149: Lori, a partner in the JKL partnership,

Q150: A limited liability company offers all "members"

Q151: The JPM Partnership is a US-based manufacturing

Q151: Catherine's basis was $50,000 in the CAR

Q152: Dan receives a proportionate nonliquidating distribution when

Q153: Fern, Inc., Ivy Inc., and Jason formed