Essay

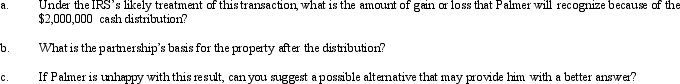

Palmer contributes property with a fair market value of $4,000,000 and an adjusted basis of $3,000,000 to AP Partnership.Palmer shares in $1,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $4,000,000.One month after the contribution, Palmer receives a cash distribution from the partnership of $2,000,000.Palmer would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Palmer's share of partnership liabilities will not change as a result of this distribution.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Match each of the following statements with

Q15: In a proportionate liquidating distribution in which

Q16: Megan's basis was $100,000 in the MAR

Q17: In a proportionate nonliquidating distribution of cash

Q18: Samuel is the managing general partner of

Q20: Melissa is a partner in a continuing

Q21: In the current year, the POD Partnership

Q22: At the beginning of the year, Elsie's

Q23: The "outside basis" is defined as a

Q204: Sharon and Sue are equal partners in