Essay

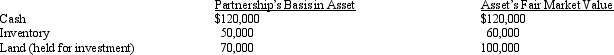

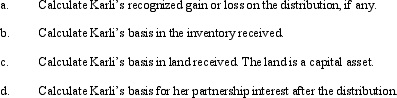

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date, she receives a proportionate nonliquidating distribution of the following assets:

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following would be currently

Q7: Maria owns a 60% interest in the

Q10: Matt receives a proportionate nonliquidating distribution.At the

Q11: Which of the following statements is always

Q12: Harry and Sally are considering forming a

Q13: In a proportionate liquidating distribution, Alexandria receives

Q14: Match each of the following statements with

Q71: Section 721 provides that no gain or

Q98: The primary purpose of the partnership agreement

Q137: In a proportionate liquidating distribution, RST Partnership