Essay

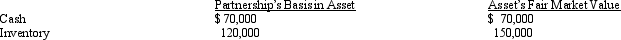

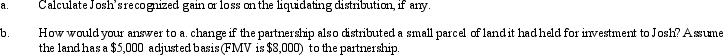

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $300,000.On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: A limited liability company generally provides limited

Q69: ABC, LLC is equally-owned by three corporations.Two

Q70: Tim, Al, and Pat contributed assets to

Q71: On January 1 of the current year,

Q73: Each partner's profit-sharing, loss-sharing, and capital-sharing ownership

Q74: Cassandra is a 10% limited partner in

Q74: BCD Partners reported the following items on

Q75: The sum of the partner's ending basis

Q76: The MOP Partnership is involved in leasing

Q125: The LN partnership reported the following items