Essay

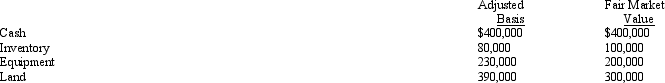

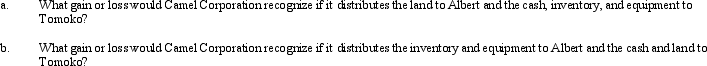

The stock in Camel Corporation is owned by Albert and Tomoko, who are unrelated.Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation. All of Camel Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Camel Corporation:

Correct Answer:

Verified

Correct Answer:

Verified

Q13: For a corporate restructuring to qualify as

Q15: Pursuant to a complete liquidation, Oriole Corporation

Q16: A corporation generally will recognize gain or

Q19: Cocoa Corporation is acquiring Milk Corporation in

Q21: One difference between the tax treatment accorded

Q22: The stock of Cardinal Corporation is held

Q25: Scarlet Corporation, the parent corporation, has a

Q42: Penguin Corporation purchased bonds (basis of $190,000)

Q43: Since debt security holders do not own

Q71: Obtaining a positive letter ruling from the