Essay

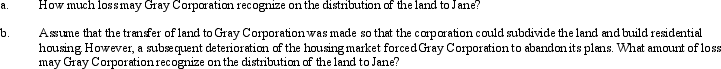

Mary and Jane, unrelated taxpayers, own Gray Corporation's stock equally.One year before the complete liquidation of Gray, Mary transfers land (basis of $420,000, fair market value of $350,000) to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $20,000 and fair market value of $95,000.In liquidation, Gray distributes the land to Jane.At the time of the liquidation, the land is worth $290,000.

Correct Answer:

Verified

Note that the § 362(e)(2) basis step-d...

Note that the § 362(e)(2) basis step-d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: The Federal income tax treatment of a

Q47: Lyon has 100,000 shares outstanding that are

Q48: Which of the following statements is true?<br>A)The

Q49: Which of the following statements is true

Q52: Yoko purchased 10% of Toyger Corporation's stock

Q52: Discuss the role of letter rulings in

Q54: In corporate reorganizations, an acquiring corporation using

Q55: Corporate shareholders would prefer to have a

Q63: Compare the sale of a corporation's assets

Q65: For corporate restructurings, meeting the § 368