Multiple Choice

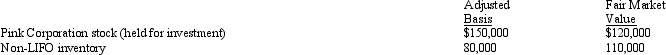

In the current year, Warbler Corporation (E & P of $250,000) made the following property distributions to its shareholders (all corporations) :  Warbler Corporation is not a member of a controlled group.As a result of the distribution:

Warbler Corporation is not a member of a controlled group.As a result of the distribution:

A) The shareholders have dividend income of $200,000.

B) The shareholders have dividend income of $260,000.

C) Warbler has a recognized gain of $30,000 and a recognized loss of $30,000.

D) Warbler has no recognized gain or loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: How does the definition of accumulated E

Q21: Hazel, Emily, and Frank, unrelated individuals, own

Q30: Duck Corporation is a calendar year taxpayer

Q38: How does the payment of a property

Q66: Hannah, Greta, and Winston own the stock

Q69: Vireo Corporation redeemed shares from its sole

Q123: An increase in the LIFO recapture amount

Q140: Puffin Corporation makes a property distribution to

Q143: Dividends paid to shareholders who hold both

Q167: Rust Corporation distributes property to its sole