Essay

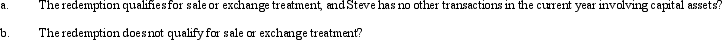

Steve has a capital loss carryover in the current year of $90,000. He owns 3,000 shares of stock in Carmine Corporation, which he purchased six years ago for $50 per share. In the current year, Carmine Corporation (E & P of $750,000) redeems all of his shares for $320,000. Steve is in the 35% tax bracket. What is his tax liability with respect to the corporate distribution if:

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Which of the following statements regarding constructive

Q58: Which of the following is a correct

Q71: Hawk Corporation has 2,000 shares of stock

Q72: Five years ago, Eleanor transferred property she

Q73: Tern Corporation, a cash basis taxpayer, has

Q76: A shareholder's holding period of property acquired

Q80: For tax purposes, all stock redemptions are

Q131: If a distribution of stock rights is

Q142: Ethel, Hannah, and Samuel, unrelated individuals, own

Q143: Which one of the following statements is