Essay

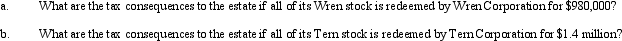

Sam's gross estate includes stock in Tern Corporation and Wren Corporation, valued at $1.4 million and $980,000, respectively.At the time of Sam's death in 2012, the stock represented 22% of Tern's outstanding stock and 27% of Wren's outstanding stock.Sam's adjusted gross estate equals $6,500,000.Death taxes and funeral and administration expenses for Sam's estate total $980,000.Sam had a basis of $350,000 in the Tern stock and $190,000 in the Wren stock at the time of his death.None of the beneficiaries of Sam's estate own (directly or indirectly) any stock in Tern Corporation, but some of the beneficiaries own stock of Wren Corporation.Consider the following independent questions.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Puffin Corporation's 2,000 shares outstanding are owned

Q58: Corporate shareholders generally receive less favorable tax

Q64: Constructive dividends do not need to satisfy

Q85: Tracy and Lance, equal shareholders in Macaw

Q90: Scarlet Corporation is an accrual basis, calendar

Q96: When computing E & P, taxable income

Q99: Cash distributions received from a corporation with

Q102: Brown Corporation, an accrual basis corporation, has

Q106: Ember Corporation has 500 shares of stock

Q160: Constructive dividends have no effect on a