Essay

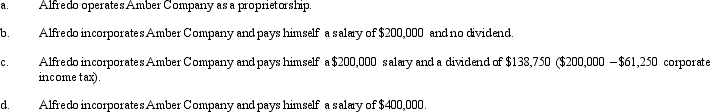

Amber Company has $400,000 in net income in 2012 before deducting any compensation or other payment to its sole owner, Alfredo. Assume that Alfredo is in the 35% marginal tax bracket. Discuss the tax aspects of each of the following independent arrangements. (Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Quail Corporation is a C corporation with

Q58: What is the annual required estimated tax

Q85: Katherine, the sole shareholder of Purple Corporation,

Q86: Luis is the sole shareholder of a

Q87: Mallard Corporation, a C corporation that is

Q88: In the current year, Amber, Inc., a

Q91: For a corporation in 2012, the domestic

Q92: During the current year, Violet, Inc., a

Q95: Robin Corporation, a calendar year C corporation,

Q116: Because of the taxable income limitation, no