Essay

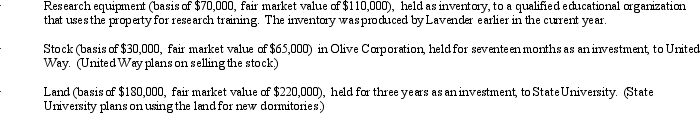

During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable contributions to qualified organizations as follows:

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The passive loss rules apply to closely

Q13: Employment taxes apply to all entity forms

Q52: Francisco is the sole owner of Rose

Q53: Heron Corporation, a calendar year, accrual basis

Q55: Eagle Company, a partnership, had a short-term

Q58: Which of the following statements is correct

Q61: During the current year, Thrasher, Inc., a

Q80: What is the purpose of Schedule M-3?

Q109: Red Corporation,which owns stock in Blue Corporation,had

Q110: Schedule M-2 is used to reconcile unappropriated