Essay

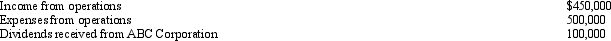

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss) for the year?

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

Quartz has an NOL, computed as...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Hippo, Inc., a calendar year C corporation,

Q19: Peach Corporation had $210,000 of active income,

Q20: Rajib is the sole shareholder of Robin

Q21: Norma formed Hyacinth Enterprises, a proprietorship, in

Q22: Erin Corporation, a personal service corporation, had

Q24: Schedule M-1 of Form 1120 is used

Q26: In the current year, Plum Corporation, a

Q27: Orange Corporation owns stock in White Corporation

Q28: A calendar year C corporation can receive

Q53: Tomas owns a sole proprietorship, and Lucy