Multiple Choice

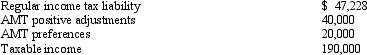

Meg, who is single and age 36, provides you with the following information from her financial records.  Calculate her AMT exemption for 2012.

Calculate her AMT exemption for 2012.

A) $0.

B) $23,450.

C) $14,075.

D) $48,450.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Are the AMT rates for the individual

Q43: Certain adjustments apply in calculating the corporate

Q60: Because passive losses are not deductible in

Q61: The exercise of an incentive stock option

Q63: Wallace owns a construction company that builds

Q65: Omar acquires used 7-year personal property for

Q66: Joel placed real property in service in

Q67: Kay had percentage depletion of $119,000 for

Q69: Factors that can cause the adjusted basis

Q106: In deciding to enact the alternative minimum