Multiple Choice

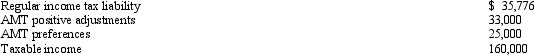

Miriam, who is a head of household and age 36, provides you with the following information from her financial records for 2012.  Calculate her AMTI for 2012.

Calculate her AMTI for 2012.

A) $0.

B) $171,300.

C) $195,925.

D) $218,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Why is there no AMT adjustment for

Q82: The AMT does not apply to qualifying

Q83: Marvin, the vice president of Lavender, Inc.,

Q84: Sage, Inc., has the following gross receipts

Q85: The AMT exemption for a C corporation

Q85: If the regular income tax deduction for

Q86: The C corporation AMT rate can be

Q89: What is the relationship between the regular

Q91: In 2012, Ben exercised an incentive stock

Q122: Durell owns a construction company that builds