Multiple Choice

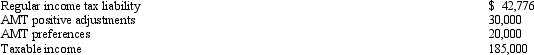

Robin, who is a head of household and age 42, provides you with the following information from his financial records for 2012.  Calculate his AMT for 2012.

Calculate his AMT for 2012.

A) $14,533.

B) $17,825.

C) $42,986.

D) $62,300.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q48: When qualified residence interest exceeds qualified housing

Q75: Which of the following can produce an

Q78: Which of the following normally produces positive

Q78: How can the positive AMT adjustment for

Q81: C corporations are subject to a positive

Q82: Since most tax preferences are merely timing

Q82: The AMT does not apply to qualifying

Q83: Marvin, the vice president of Lavender, Inc.,

Q84: Sage, Inc., has the following gross receipts

Q96: What effect do deductible gambling losses for