Multiple Choice

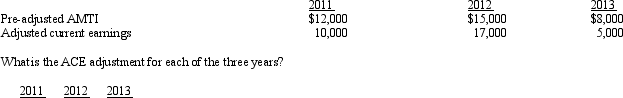

Mauve, Inc., has the following for 2011, 2012, and 2013 and no prior ACE adjustments.

A) $0 $1,500 ($1,500)

B) ($2,000) $2,000 ($3,000)

C) $2,000 ($2,000) $3,000

D) ($1,500) $1,500 $2,250

E) $1,500 ($1,500) ($2,250)

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Certain adjustments apply in calculating the corporate

Q67: Kay had percentage depletion of $119,000 for

Q69: Factors that can cause the adjusted basis

Q70: Which of the following statements is incorrect?<br>A)If

Q71: In September, Dorothy purchases a building for

Q73: Altrice incurs circulation expenditures of $180,000 in

Q75: Which of the following can produce an

Q78: How can the positive AMT adjustment for

Q82: Since most tax preferences are merely timing

Q96: What effect do deductible gambling losses for