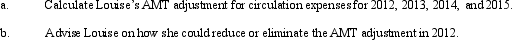

Essay

In 2012, Louise incurs circulation expenses of $330,000 which she deducts in calculating taxable income.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: In 2012, Sean incurs $90,000 of mining

Q7: Celia and Amos, who are married filing

Q8: In calculating her taxable income, Rhonda deducts

Q9: In determining the amount of the AMT

Q10: Prior to the effect of tax credits,

Q12: Is it possible that no AMT adjustment

Q13: Frederick sells land and building whose adjusted

Q14: Which of the following statements is correct?<br>A)The

Q15: Assuming no phaseout, the AMT exemption amount

Q16: Negative AMT adjustments for the current year