Essay

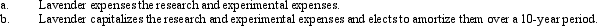

Lavender, Inc., incurs research and experimental expenditures of $210,000 in 2012.Determine the amount of the AMT adjustment for 2012 and for 2013 if for regular income tax purposes:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: Ashlyn is subject to the AMT in

Q21: Vicki owns and operates a news agency

Q22: Vinny's AGI is $220,000.He contributed $130,000 in

Q24: If a gambling loss itemized deduction is

Q26: If circulation expenditures are amortized over a

Q27: All of a C corporation's AMT is

Q28: If the taxpayer elects to capitalize intangible

Q30: Keosha acquires 10-year personal property to use

Q54: If a taxpayer deducts the standard deduction

Q55: The phaseout of the AMT exemption amount