Multiple Choice

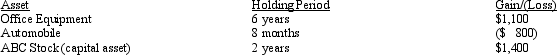

The following assets in Jack's business were sold in 2012:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

A) $1,700 LTCG.

B) $600 LTCG and $300 ordinary gain.

C) $1,400 LTCG and $300 ordinary gain.

D) $2,500 LTCG and $800 ordinary loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: An individual taxpayer with 2012 net short-term

Q14: Betty, a single taxpayer with no dependents,

Q17: In 2012, Mark has $18,000 short-term capital

Q20: If there is a net § 1231

Q22: Property sold to a related party purchaser

Q23: Which of the following creates potential §

Q58: A lessor is paid $45,000 by its

Q67: The § 1245 depreciation recapture potential does

Q70: Section 1250 depreciation recapture will apply when

Q92: The only things that the grantee of