Essay

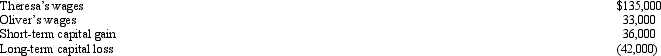

Theresa and Oliver, married filing jointly, and both over 65 years of age, have no dependents.Their 2012 income tax facts are:

What is their taxable income for 2012?

What is their taxable income for 2012?

Correct Answer:

Verified

The couple's taxable income is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The couple's taxable income is...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q12: Which of the following would extinguish the

Q27: Section 1231 property generally does not include

Q51: Ramon is in the business of buying

Q80: Martha has both long-term and short-term 2011

Q81: Charmine, a single taxpayer with no dependents,

Q83: Carol had the following transactions during 2012:

Q86: Sara is filing as head of household

Q89: Nonrecaptured § 1231 losses from the seven

Q90: "Collectibles" held long-term and sold at a

Q143: When a patent is transferred, the most