Essay

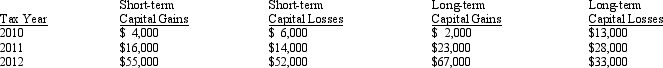

The chart below details Sheen's 2010, 2011, and 2012 stock transactions.What is the capital loss carryover to 2012 and what is the net capital gain or loss for 2012?

Correct Answer:

Verified

There was a $2,000 net short-term capita...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Describe the circumstances in which the potential

Q18: Short-term capital losses are netted against long-term

Q34: Which of the following is correct concerning

Q34: Since the Code section that defines capital

Q84: Hilda lent $2,000 to a close personal

Q96: What characteristics must the seller of a

Q98: Marvin is in the business of song

Q103: Mauve Company signs a 13-year franchise agreement

Q105: A business taxpayer sells depreciable business property

Q125: A barn held more than one year