Essay

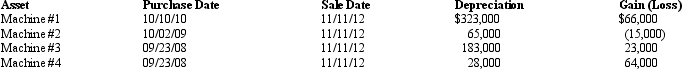

A business taxpayer sold all the depreciable assets of the business, calculated the gains and losses, and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Correct Answer:

Verified

The taxpayer has adjusted gross income o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: For § 1245 recapture to apply, accelerated

Q119: A business taxpayer trades in a used

Q120: Section 1245 generally recaptures as ordinary income

Q121: To compute the holding period, start counting

Q122: Ryan has the following capital gains and

Q124: Robin Corporation has ordinary income from operations

Q125: When an individual taxpayer has a net

Q126: Red Company had an involuntary conversion on

Q127: In early 2011, Wendy paid $66,000 for

Q128: Tan, Inc., has a 2012 $50,000 long-term