Essay

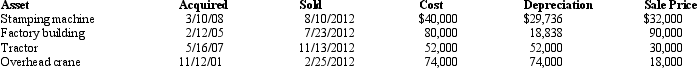

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

The stamping machine ($21,736), tractor ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Spencer has an investment in two parcels

Q15: Section 1231 applies to the sale or

Q42: Section 1231 property includes nonpersonal use property

Q80: Tom has owned 40 shares of Orange

Q111: Which of the following assets held by

Q135: Which of the following would not be

Q137: Siva operates a retail music store as

Q142: On January 18, 2011, Martha purchased 200

Q143: Martha is single with one dependent and

Q144: Orange Company had machinery destroyed by a