Essay

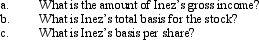

Inez's adjusted basis for 9,000 shares of Cardinal, Inc.common stock is $900,000.During the year, she receives a 5% stock dividend that is a nontaxable stock dividend.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q21: What types of exchanges of insurance contracts

Q63: Felix gives 100 shares of stock to

Q65: After 5 years of marriage, Dave and

Q67: If a taxpayer purchases taxable bonds at

Q71: Melissa, age 58, marries Arnold, age 50,

Q73: Robert sold his ranch which was his

Q119: What is the difference between the depreciation

Q206: Discuss the relationship between the postponement of

Q217: Discuss the effect of a liability assumption

Q239: How is the donee's basis calculated for