Essay

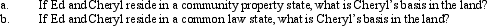

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $300,000.Ed dies in 2012, when the fair market value of the land is $500,000.Under the joint ownership arrangement, the land passed to Cheryl.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: On January 5, 2012, Waldo sells his

Q3: Emma gives her personal use automobile (cost

Q5: What is a deathbed gift and what

Q6: Annette purchased stock on March 1, 2012,

Q28: To be eligible to elect postponement of

Q102: How does the replacement time period differ

Q133: Discuss the relationship between realized gain and

Q142: Monica sells a parcel of land to

Q167: Define fair market value as it relates

Q174: What effect does a deductible casualty loss