Essay

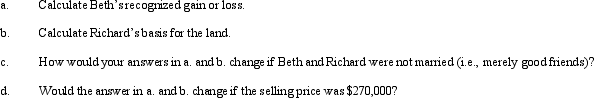

Beth sells investment land (adjusted basis of $225,000) that she has owned for 6 years to her husband, Richard, for its fair market value of $195,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: What effect do the assumption of liabilities

Q10: Under what circumstances may a partial §

Q11: What is the general formula for calculating

Q27: Discuss the application of holding period rules

Q37: On September 18, 2012, Jerry received land

Q40: Eunice Jean exchanges land held for investment

Q48: Mandy and Greta form Tan, Inc., by

Q49: Under what circumstance is there recognition of

Q106: Explain how the sale of investment property

Q208: Discuss the logic for mandatory deferral of