Multiple Choice

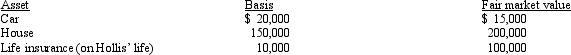

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin, a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

A) $20,000 $150,000 $ 10,000

B) $17,500 $175,000 $ 10,000

C) $17,500 $175,000 $100,000

D) $15,000 $200,000 $100,000

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: On October 1, Paula exchanged an apartment

Q52: Ashley sells real property for $280,000.The buyer

Q53: The taxpayer can elect to have the

Q55: Alex used the § 121 exclusion three

Q56: During 2012, Ted and Judy, a married

Q59: Which of the following satisfy the time

Q60: Purchased goodwill is assigned a basis equal

Q61: Al owns stock with an adjusted basis

Q62: An exchange of business or investment property

Q221: Joyce's office building was destroyed in a