Multiple Choice

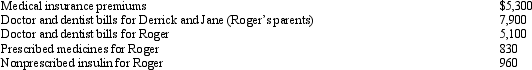

Roger is employed as an actuary.For calendar year 2012, he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

A) $9,750.

B) $10,340.

C) $19,130.

D) $20,090.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: For purposes of computing the deduction for

Q42: Emily, who lives in Indiana, volunteered to

Q48: Jack sold a personal residence to Steven

Q56: Sergio was required by the city to

Q64: In 2013, Rhonda received an insurance reimbursement

Q71: Phillip developed hip problems and was unable

Q72: Which of the following items would be

Q73: In 2012, Dena traveled 545 miles for

Q81: Leona borrows $100,000 from First National Bank

Q88: For purposes of computing the deduction for