Multiple Choice

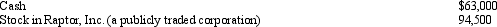

During 2012, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

A) $56,700.

B) $63,000.

C) $94,500.

D) $157,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: For purposes of computing the deduction for

Q48: Jack sold a personal residence to Steven

Q71: Phillip developed hip problems and was unable

Q72: Which of the following items would be

Q73: In 2012, Dena traveled 545 miles for

Q75: A medical expense does not have to

Q76: Ronaldo contributed stock worth $12,000 to the

Q77: Gerald, a physically handicapped individual, pays $9,000

Q78: In 2012, Jerry pays $8,000 to become

Q79: John gave $1,000 to a family whose