Multiple Choice

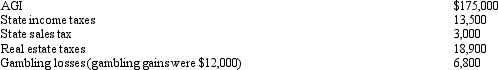

Paul, a calendar year married taxpayer, files a joint return for 2012. Information for 2012 includes the following:  Paul's allowable itemized deductions for 2012 are:

Paul's allowable itemized deductions for 2012 are:

A) $13,500.

B) $32,400.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Grace's sole source of income is from

Q37: During the year, Eve (a resident of

Q45: Interest paid or accrued during the tax

Q96: In 2012 Michelle, single, paid $2,500 interest

Q97: Jeanne had an accident while hiking on

Q99: Sadie mailed a check for $2,200 to

Q100: In 2012, Boris pays a $3,800 premium

Q101: Margaret, who is self-employed, paid $6,000 for

Q102: Joseph and Sandra, married taxpayers, took out

Q106: Linda borrowed $60,000 from her parents for