Essay

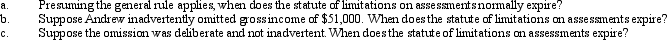

For the tax year 2012, Andrew reported gross income of $200,000 on his timely filed Federal income tax return.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q41: One of the motivations for making a

Q64: Because the law is complicated, most individual

Q119: Burt and Lisa are married and live

Q121: Using the choices provided below, show the

Q122: Timothy recently converted a warehouse into apartment

Q123: Federal excise taxes that are no longer

Q125: For individual taxpayers, the interest rate for

Q126: A VAT (value added tax):<br>A)Is regressive in

Q127: In terms of Adam Smith's canons of

Q129: Pam, a widow, makes cash gifts to