Essay

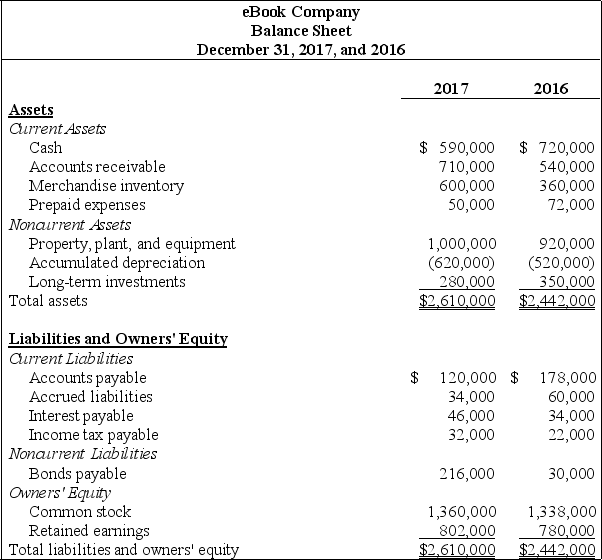

eBook Company's most recent balance sheet,income statement,and other important information for 2017 are presented below.

Additional data for 2017

Sold equipment with a book value of $38,000 (= $198,000 cost * $160,000 accumulated depreciation)for $78,000 cash.

Purchased equipment for $278,000 cash.

Sold long-term investments for $74,000 cash.These investments had an original cost of $80,000.

Purchased long-term investments for $10,000 cash.

Issued bonds for $186,000 cash.

Issued common stock for $22,000 cash.

Declared and paid $52,000 in cash dividends.

Prepare a statement of cash flows for the year ended December 31,2017,using the indirect method.

The owner of eBook Company wants to know why cash decreased from $720,000 to $590,000 given the company's net income of $74,000.Use the information in the statement of cash flows to briefly explain why cash decreased.

Correct Answer:

Verified

b. Overall, cash decreased by  . The ow...

. The ow...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. Overall, cash decreased by

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: The end goal of preparing the statement

Q57: Firms with significant net income always have

Q58: Exhibit 12-1<br>Ellie Inc.has the following cash flows

Q59: With respect to the statement of cash

Q60: Exhibit 12-1<br>Ellie Inc.has the following cash flows

Q61: When preparing the operating activities section of

Q62: Exhibit 12-3<br>Stalwart Inc. accounting records show the

Q63: Exhibit 12-4<br>Manning Company uses the indirect

Q64: Factory equipment sold for cash would appear

Q66: The operating cash flow ratio measures:<br>A)the company's