Multiple Choice

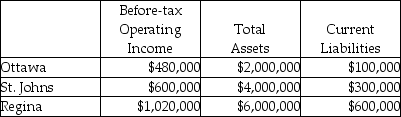

Use the information below to answer the following question(s) .Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million) .The cost of equity capital is 5 percent, while the tax rate is 30 percent.Brandorf Company has profit centres in the following locations with the following data:

-What is EVA for St.Johns?

A) $142,200

B) $190,600

C) $310,600

D) $200,000

E) $145,000

Correct Answer:

Verified

Correct Answer:

Verified

Q63: Current cost return on investment is a

Q85: Use the information below to answer the

Q86: The Shamrock Corporation manufactures flower pots in

Q87: Use the information below to answer the

Q88: Use the information below to answer the

Q89: Consolidated Gas Supply Corporation uses the investment

Q91: A part of a control system that

Q92: Deciding if all subunits should have the

Q93: Using gross book value as an investment

Q94: The first step in designing accounting based