Essay

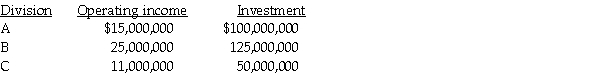

Capital Investments has three divisions.Each division's required rate of return is 15 percent.Planned operating results for next year are:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a.Compute the current ROI for each division.

b.Compute the current residual income for each division.

c.Rank the divisions according to their current ROIs and residual incomes.

d.Determine the effects after adding the new project to each division's ROI and residual income.

e.Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

Correct Answer:

Verified

Only the manager of A is pleased with t...

Only the manager of A is pleased with t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: The following table presents information related to

Q16: Last year Reynolds Ltd.reported the following results:<br>

Q21: During the past year Badger Company had

Q35: Use the information below to answer the

Q73: Briefly explain each of the four levers

Q83: Current cost is the cost of purchasing

Q85: Use the information below to answer the

Q93: Using gross book value as an investment

Q125: Gasfield Maintenance Ltd.purchased equipment for $225,000 that

Q143: List and describe the steps involved in